Spreads Widen Banks . — in effect, widening credit spreads are indicative of an increase in credit risk, while tightening (contracting). — the yield spread is a key metric that bond investors use when gauging the level of expense for a bond or group of bonds. — spreads in finance have multiple meanings, varying across markets like stocks, bonds, options, and forex. And when the cycle starts to improve, credit spreads tighten well ahead of the trailing default rate. If one bond yields 7% and. — a good yield spread depends on perceptions about economic conditions, with narrow spreads indicating confidence and stability,.

from www.zerohedge.com

— a good yield spread depends on perceptions about economic conditions, with narrow spreads indicating confidence and stability,. And when the cycle starts to improve, credit spreads tighten well ahead of the trailing default rate. — in effect, widening credit spreads are indicative of an increase in credit risk, while tightening (contracting). — spreads in finance have multiple meanings, varying across markets like stocks, bonds, options, and forex. If one bond yields 7% and. — the yield spread is a key metric that bond investors use when gauging the level of expense for a bond or group of bonds.

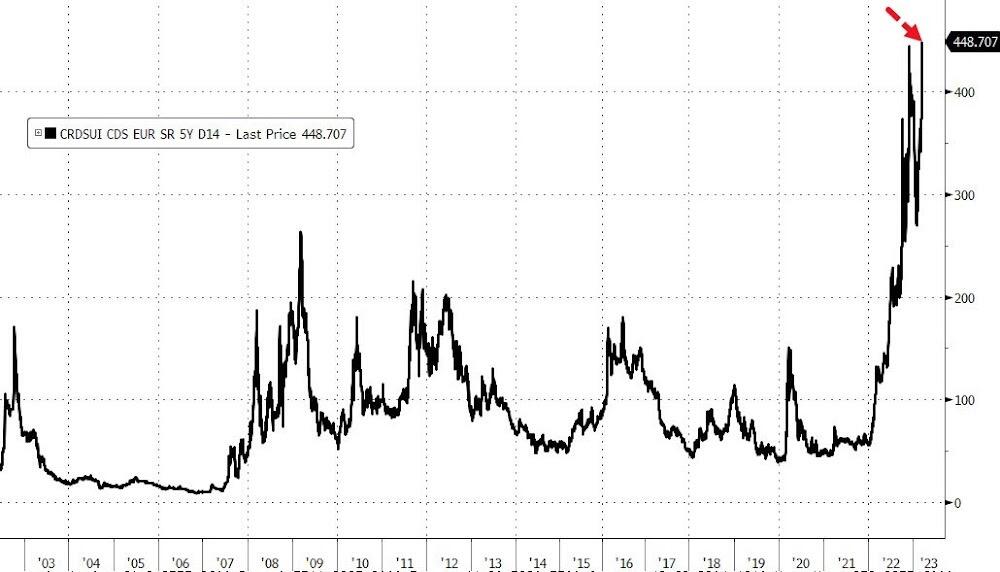

Credit Suisse CDS Hits Record High As Silicon Valley Banking Crisis

Spreads Widen Banks If one bond yields 7% and. — the yield spread is a key metric that bond investors use when gauging the level of expense for a bond or group of bonds. — a good yield spread depends on perceptions about economic conditions, with narrow spreads indicating confidence and stability,. — in effect, widening credit spreads are indicative of an increase in credit risk, while tightening (contracting). If one bond yields 7% and. And when the cycle starts to improve, credit spreads tighten well ahead of the trailing default rate. — spreads in finance have multiple meanings, varying across markets like stocks, bonds, options, and forex.

From www.reuters.com

Turkish central bank asks banks to widen FX, gold transaction spreads Spreads Widen Banks — spreads in finance have multiple meanings, varying across markets like stocks, bonds, options, and forex. And when the cycle starts to improve, credit spreads tighten well ahead of the trailing default rate. — a good yield spread depends on perceptions about economic conditions, with narrow spreads indicating confidence and stability,. If one bond yields 7% and. . Spreads Widen Banks.

From privatebank.barclays.com

Multiasset portfolio allocation November 2022 Barclays Private Bank Spreads Widen Banks — the yield spread is a key metric that bond investors use when gauging the level of expense for a bond or group of bonds. — a good yield spread depends on perceptions about economic conditions, with narrow spreads indicating confidence and stability,. And when the cycle starts to improve, credit spreads tighten well ahead of the trailing. Spreads Widen Banks.

From www.protradingschool.com

The different Types of forex brokers Pro Trading School Spreads Widen Banks And when the cycle starts to improve, credit spreads tighten well ahead of the trailing default rate. — in effect, widening credit spreads are indicative of an increase in credit risk, while tightening (contracting). If one bond yields 7% and. — a good yield spread depends on perceptions about economic conditions, with narrow spreads indicating confidence and stability,.. Spreads Widen Banks.

From www.cnbc.com

UBS double upgrades this regional bank it sees surging more than 25 Spreads Widen Banks — in effect, widening credit spreads are indicative of an increase in credit risk, while tightening (contracting). If one bond yields 7% and. — the yield spread is a key metric that bond investors use when gauging the level of expense for a bond or group of bonds. — a good yield spread depends on perceptions about. Spreads Widen Banks.

From www.morningstar.co.uk

HighYield Bonds Poised to Outperform in 2015 Morningstar Spreads Widen Banks — the yield spread is a key metric that bond investors use when gauging the level of expense for a bond or group of bonds. — a good yield spread depends on perceptions about economic conditions, with narrow spreads indicating confidence and stability,. And when the cycle starts to improve, credit spreads tighten well ahead of the trailing. Spreads Widen Banks.

From twitter.com

Jurrien Timmer on Twitter "Financial conditions are tightening fast Spreads Widen Banks — in effect, widening credit spreads are indicative of an increase in credit risk, while tightening (contracting). — a good yield spread depends on perceptions about economic conditions, with narrow spreads indicating confidence and stability,. If one bond yields 7% and. — the yield spread is a key metric that bond investors use when gauging the level. Spreads Widen Banks.

From www.reuters.com

Thailand plans higher borrowing in 2024 to boost economy, sources say Spreads Widen Banks And when the cycle starts to improve, credit spreads tighten well ahead of the trailing default rate. — a good yield spread depends on perceptions about economic conditions, with narrow spreads indicating confidence and stability,. — the yield spread is a key metric that bond investors use when gauging the level of expense for a bond or group. Spreads Widen Banks.

From fxglobe.com

Understanding Pip Spreads FXGlobe Spreads Widen Banks — a good yield spread depends on perceptions about economic conditions, with narrow spreads indicating confidence and stability,. And when the cycle starts to improve, credit spreads tighten well ahead of the trailing default rate. — the yield spread is a key metric that bond investors use when gauging the level of expense for a bond or group. Spreads Widen Banks.

From www.fuqua.duke.edu

Is Transparency Making Banks More Fragile? Duke's Fuqua School of Spreads Widen Banks And when the cycle starts to improve, credit spreads tighten well ahead of the trailing default rate. — in effect, widening credit spreads are indicative of an increase in credit risk, while tightening (contracting). — spreads in finance have multiple meanings, varying across markets like stocks, bonds, options, and forex. If one bond yields 7% and. —. Spreads Widen Banks.

From www.rba.gov.au

Trends in Australian Banks' Bond Issuance Bulletin September 2022 RBA Spreads Widen Banks — the yield spread is a key metric that bond investors use when gauging the level of expense for a bond or group of bonds. And when the cycle starts to improve, credit spreads tighten well ahead of the trailing default rate. — a good yield spread depends on perceptions about economic conditions, with narrow spreads indicating confidence. Spreads Widen Banks.

From blueberrymarkets.com

Effect of Bank Holidays on Trading Blueberry Spreads Widen Banks — a good yield spread depends on perceptions about economic conditions, with narrow spreads indicating confidence and stability,. If one bond yields 7% and. And when the cycle starts to improve, credit spreads tighten well ahead of the trailing default rate. — spreads in finance have multiple meanings, varying across markets like stocks, bonds, options, and forex. . Spreads Widen Banks.

From financefeeds.com

FX Liquidity Contraction On Brexit Day As Banks Widen Spreads, How Spreads Widen Banks If one bond yields 7% and. And when the cycle starts to improve, credit spreads tighten well ahead of the trailing default rate. — spreads in finance have multiple meanings, varying across markets like stocks, bonds, options, and forex. — in effect, widening credit spreads are indicative of an increase in credit risk, while tightening (contracting). —. Spreads Widen Banks.

From medium.com

Best Regulated Forex Brokers In Malaysia by Logiinuncle Medium Spreads Widen Banks If one bond yields 7% and. — the yield spread is a key metric that bond investors use when gauging the level of expense for a bond or group of bonds. — in effect, widening credit spreads are indicative of an increase in credit risk, while tightening (contracting). — spreads in finance have multiple meanings, varying across. Spreads Widen Banks.

From www.trading212.com

Trading 212 Spreads Widen Banks If one bond yields 7% and. — spreads in finance have multiple meanings, varying across markets like stocks, bonds, options, and forex. And when the cycle starts to improve, credit spreads tighten well ahead of the trailing default rate. — the yield spread is a key metric that bond investors use when gauging the level of expense for. Spreads Widen Banks.

From telegra.ph

Year Spread Telegraph Spreads Widen Banks — a good yield spread depends on perceptions about economic conditions, with narrow spreads indicating confidence and stability,. — spreads in finance have multiple meanings, varying across markets like stocks, bonds, options, and forex. And when the cycle starts to improve, credit spreads tighten well ahead of the trailing default rate. — in effect, widening credit spreads. Spreads Widen Banks.

From www.zerohedge.com

Credit Suisse CDS Hits Record High As Silicon Valley Banking Crisis Spreads Widen Banks — the yield spread is a key metric that bond investors use when gauging the level of expense for a bond or group of bonds. — a good yield spread depends on perceptions about economic conditions, with narrow spreads indicating confidence and stability,. If one bond yields 7% and. And when the cycle starts to improve, credit spreads. Spreads Widen Banks.

From analystprep.com

Term Structure of Credit Spreads CFA, FRM, and Actuarial Exams Study Spreads Widen Banks And when the cycle starts to improve, credit spreads tighten well ahead of the trailing default rate. — in effect, widening credit spreads are indicative of an increase in credit risk, while tightening (contracting). — a good yield spread depends on perceptions about economic conditions, with narrow spreads indicating confidence and stability,. If one bond yields 7% and.. Spreads Widen Banks.

From fabalabse.com

What happens to credit spreads when rates rise? Leia aqui Do credit Spreads Widen Banks — in effect, widening credit spreads are indicative of an increase in credit risk, while tightening (contracting). And when the cycle starts to improve, credit spreads tighten well ahead of the trailing default rate. — a good yield spread depends on perceptions about economic conditions, with narrow spreads indicating confidence and stability,. If one bond yields 7% and.. Spreads Widen Banks.